The main thrust of AMD's CES 2021 announcements revolved around the release of Ryzen 5000 Series Mobile processors. Codenamed Cezanne and primed for thin-and-light (U-Series) and gaming (H-Series) notebooks, they build on the in-market Ryzen 4000 Series Mobile by upgrading the CPU architecture from Zen 2 to Zen 3 whilst also offering higher peak frequencies. On the integrated graphics front, however, the older Vega architecture is carried over, which is a shame considering the focus AMD has put on the latest RDNA2 blueprint powering premium discrete graphics cards.

In other news, AMD also announced the OEM-only Ryzen 9 5900 and Ryzen 7 5800 processors equipped with a reduced 65W TDP. 3rd Generation EPYC also got a mention through a demo of a weather forecasting simulation running on dual 32-core 'Milan' chips.

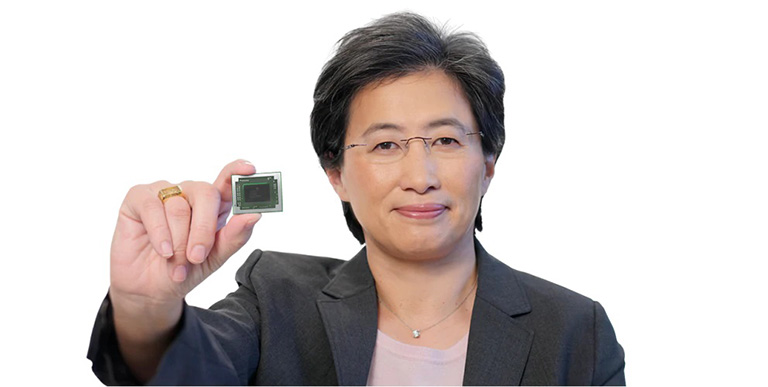

This brief recap set the scene for a virtual video press roundtable that followed on directly from AMD's livestream yesterday. As a sign of the times, a select few publications were invited to field questions, over Microsoft Teams, to AMD CEO and President, Dr Lisa Su, covering these CES announcements and more. I managed to get a few in, so what follows is a Q+A-style format.

HEXUS - Appreciating that many hardware tech companies are facing similar challenges from a supply point of view, with industry giants such as TSMC having difficulty in securing enough quantity of essential materials such as ABF substrate, and other components being scarcer and more expensive than usual, I wondered how AMD perceived the situation in the near-term and when it expected supply to get back closer to a long-term normal.

Lisa Su - I think it is fair to say that you've seen some reports of substrate shortages, and we also see tightness in the substrate market. This is more a function of that demand has outstripped overall worldwide capacity. We do see more capacity coming online, including AMD investments, but it takes some time get those online. The industry is overall reacting in ensuring that we do put more capacity online, and I expect that to happen through 2021.

We are shipping lots of parts. Manufacturing volumes are continuing to increase across gaming, graphics as well as CPU, and I expect that to happen throughout 2021. I think there will be product tightness, certainly through the first half of this year, but we continue to ship more into our OEM partners as well as our channel partners, to increase overall supply. We completely understand why consumers want more, so supply catch-up is very high up on the priority list.

We're actually not phasing out Radeon 6000 Series MBA (Made By AMD) reference boards for the purpose of trying to ensure that there is extra supply. As stock becomes available, we will offer it on AMD.com at SEP pricing, and we'll encourage our partners to do that as well. I will also say there are some COVID-related logistics and commodity component price increases, and I think some of that is what is blowing through right now.

HEXUS - Moving back to the releases announced yesterday, particularly the thought process behind pairing cutting-edge Zen 3 CPU cores alongside older Vega graphics on Ryzen 5000 Series Mobile, I mused whether it was fair that some customers could be disappointed that AMD hadn't moved the needle on the GPU side as much as some had hoped for, especially given the rapid cadence of product releases over recent years and rival Intel really upping its IGP game in the same space.

Lisa Su - Cezanne (Ryzen 5000 Series Mobile) is a phenomenal product. We're very happy with it, and it takes it up to another level from Renoir (Ryzen 4000 Series Mobile). The choice of what you put into a product is made quite a while ago (years, in fact), and we feel that we made a good set of choices. There isn't any concern on that front.

Shipping production units of Cezanne in early 2021 was very important to us. The reason for that is, if you think about the entire OEM cycle, we have a whole bunch of platforms that will launch in early 2021, which is a nice way to build cadence. Regarding the exact choices, it's really a matter of cadence and where we want to be at that point in time.

Some thought we might have left Renoir in the market a while longer, but we thought there would be high demand for Zen 3 in the notebook form factor, so we prioritised that for Ryzen 5000 Series Mobile.

As we move forwards, this is all about what user experience we can bring to the PC market. It's important for all of us in the PC ecosystem to show people what you can really do, and how experiences can get better. This is what we think about on the post-Cezanne roadmap.

HEXUS - Your competitors have been integrating AI-optimisations into hardware for a short while now and they see it as a huge opportunity for growth. AMD doesn't appear to have that right at this moment, can you give us some colour on your thoughts on AI and hardware moving forwards?

Lisa Su - I think you will see us talk more about that in the coming years. We're certainly making investments in AI. We have our CDNA architecture on the datacentre/GPU side; you'll see some more upgrades to that. You will also see us add more capability in our CPUs and GPUs. That is an investment area for AMD, and you'll see more as we bring them out in products.

HEXUS - Large tech companies like to create branding and marketing niches that, if done well, become distinct segments in their own right and help catalyse further sales. Intel famously did this with Centrino back in the day and Nvidia is trying something similar with RTX Studio on the desktop and laptop. Appreciating AMD's CPU strength in mobile through processors housing up to 16 Zen 3 threads and the promise of high-performance RDNA2-powered discrete mobile GPUs to follow this year, I wondered whether AMD had any thoughts about creating a new Mobile Creator segment of its own.

Lisa Su - We believe that content creation is a very important category overall, whether you are talking about CPUs or GPUs. There are opportunities for branding or specialised SKUs for content creators. Primarily it's been a case of getting as much computing horsepower as possible on CPUs and GPUs, with high-speed interfaces between them.

HEXUS - Appreciating the outstanding performance of the ARM-based Apple M1 processor and Intel integrating large and small cores into the upcoming Alder Lake 12th Gen Core chips, I was interested to find out AMD's current thoughts on hybrid-core computing and whether we'd see it in architecture any time soon.

Lisa Su - There is good work going on in that space. We continue to look at what is the right balance between big cores, medium cores and small cores. My team will be willing to talk about more as we go through it. Overall, the Zen design point is actually well-balanced and optimised if you look at performance, area, and power consumption. We would have to see a significant value-add to put something else into that mix.

There was also some interesting discussion on how quickly Apple has been able to design and build a compelling CPU (M1) - with work almost certainly going on behind the scenes to build high-performance GPUs - and whether x86 remains the optimal architecture for a wide range of products in the next five-to-10 years. Lisa wouldn't be drawn on the explicit challenges posed by successive ARM-based designs, other than to say the architecture discussion is a great validation for how important computing is throughout the ecosystem. x86 remains a very strong ecosystem and AMD will continue to invest heavily in that high-performance roadmap, Lisa said, but she also sees significant opportunities for large customers requiring semi-custom products for specific workloads.

As a wrap, my takeaway is that stock shortages will persist. Underscored by a huge rise in demand, we're not likely to see stock levels reach long-term normals until at least the second half of this year. AMD is keen in maximising opportunity in the notebook space by having enough product in the market for all the major OEMs, so it is understandable that Cezanne represents a mid-refresh rather than complete CPU and GPU revamp.

On the server front, it is business as usual, with AMD's main aim of 2021 being solidification of its position through easy adoption for 3rd Generation Milan EPYC CPUs.