Press release

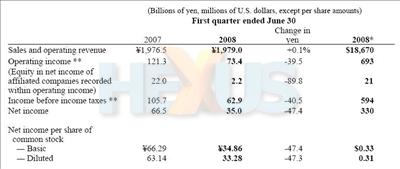

Tokyo, July 29, 2008 -- Sony Corporation today announced its consolidated results for the first quarter ended June 30, 2008 (April 1, 2008 to June 30, 2008).

- Consolidated sales remained unchanged year-on-year; local currency sales increased 8%.

- In the Game segment, performance improved significantly and operating income was recorded.

- In the Electronics segment, operating income decreased year-on-year mainly due to increased price competition and a decrease in equity in net income of affiliated companies.

- BRAVIA LCDTM television profitability improved.

Unless otherwise specified, all amounts are presented on the basis of Generally Accepted Accounting Principles in the U.S. (“U.S. GAAP”).

* U.S. dollar amounts have been translated from yen, for convenience only, at the rate of ¥106=U.S.$1, the approximate Tokyo foreign exchange market rate as of June 30, 2008.

** Sony periodically reviews the presentation of its financial information to ensure that it is consistent with the way management views its consolidated operations. Since Sony considers Sony Ericsson Mobile Communications AB (“Sony Ericsson”), S-LCD Corporation (“S-LCD”) and SONY BMG MUSIC ENTERTAINMENT (“SONY BMG”) (which together constitute a majority of Sony’s equity investments) to be integral to Sony’s operations, Sony determined the most appropriate method to report equity in net income or loss of all affiliated companies was as a component of operating income, effective from the first quarter of the fiscal year ending March 31, 2009. Of the above equity affiliates, the equity earnings from Sony Ericsson and S-LCD are recorded within the operating income of the Electronics segment and the equity earnings from SONY BMG are recorded within All Other. In connection with this reclassification, consolidated operating income, operating income of each segment and consolidated income before income taxes for the first quarter of the fiscal year ended March 31, 2008 have been reclassified to conform with the current quarter presentation.

Consolidated Results for the First Quarter Ended June 30, 2008

Sales and operating revenue (“sales”) increased 0.1% compared to the same quarter of the previous fiscal year (“year-on-year”).

Electronics segment sales increased 0.7% year-on-year due to an increase in sales of products such as BRAVIA LCD televisions. In the Game segment, sales increased 16.8% year-on-year primarily as a result of an increase in sales of PLAYSTATION3 (“PS3”) and PSP (PlayStation Portable) (“PSP”). In the Pictures segment, there was a 31.0% decrease in sales year-on-year primarily because no film released theatrically in the current quarter performed as strongly as Spider-Man 3, which was released in the same quarter of the prior year. In the Financial Services segment, although revenue from insurance premiums at Sony Life Insurance Co., Ltd. (“Sony Life”) increased, revenue decreased by 1.0% year-on-year due to a decrease in net valuation gains from convertible bonds in the general account and lower net gains from investments in the separate account.

On a local currency basis, consolidated sales increased 8% year-on-year. For references to sales on a local currency basis, see Note on page 8.

Operating income decreased 39.5% year-on-year.

In the Electronics segment, operating income decreased mainly due to increased price competition and a decrease in equity in net income for Sony Ericsson. In the Game segment, operating income was recorded compared with an operating loss recorded in the same quarter of the previous fiscal year mainly due to improved profitability of the PS3 business resulting from PS3 hardware cost reductions and increased sales of PS3 software, as well as strong sales of PSP hardware.

In the Pictures segment, an operating loss was recorded mainly due to the decrease in theatrical revenues and a significant increase in theatrical marketing expenses year-on-year related to upcoming film releases. In the Financial Services segment, operating income decreased year-on-year mainly due to a decline in net valuation gains from convertible bonds in the general account of Sony Life.

Restructuring charges of ¥0.6 billion ($5 million) were recorded as operating expenses this quarter compared to ¥3.4 billion in the same quarter of the previous year.

Equity in net income of affiliated companies recorded within operating income decreased 89.8% year-on-year to ¥2.2 billion ($21 million). Sony recorded equity in net income for Sony Ericsson of ¥0.6 billion ($5 million), a decrease of ¥17.1 billion year-on-year primarily due to a less favorable product mix, especially in Europe, increased overall price competition, and higher R&D investments as a percentage of sales.

Sony recorded equity in net loss of ¥2.5 billion ($24 million) for SONY BMG, a deterioration of ¥3.8 billion from the equity in net income recorded in the same quarter of the previous year reflecting the impact of the continued decline of the worldwide physical music market, higher restructuring costs and the non-recurrence of a prior year gain on sale of an interest in a joint venture of SONY BMG. Equity in net income of ¥2.6 billion ($24 million) was recorded for S-LCD, a joint-venture with Samsung Electronics Co., Ltd., a year-on-year increase of ¥1.1 billion.

Income before income taxes was ¥62.9 billion ($594 million), a year-on-year decrease of 40.5%, due to the decrease in operating income discussed above.

Income taxes: During the quarter, Sony recorded ¥19.0 billion ($180 million) of income taxes resulting in an effective tax rate of 30.2%. The effective tax rate was lower than the Japanese statutory tax rate mainly due to the reversal of valuation allowances at certain Sony subsidiaries as the tax benefits previously not recognized are now expected to be realized.

Minority interest in income of consolidated subsidiaries was ¥8.9 billion ($84 million), compared with a ¥0.4 billion loss in the same quarter of the previous fiscal year. Minority interest income was recorded during the quarter due to the decrease in ownership of Sony Financial Holdings Inc. (“SFH”) by Sony Corporation from 100% to 60% as a result of the global initial public offering of SFH shares in October 2007.

As a result of the changes in the items discussed above, net income decreased 47.4% year-on-year to ¥35.0 billion ($330 million).

To view the full announcement, paste the following link into your web browser: