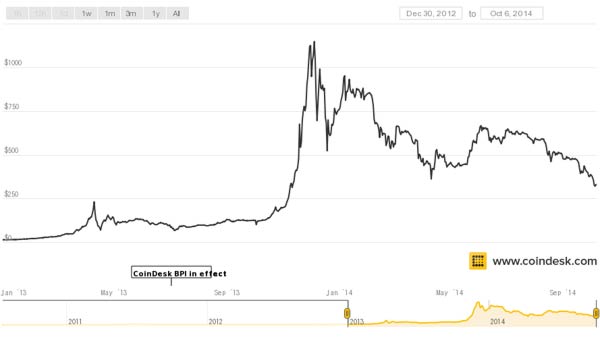

The value of bitcoins has hit its lowest level for almost a year, plummeting to $290 (£181) over the weekend, loosing around 18 per cent of its value before rebounding, reports the BBC. The cryptocurrency's value fell from $356 on Saturday to a low of $290 on Sunday, according to CoinDesk's Bitcoin Price Index, but values have now recovered to an individual bitcoin value of around $330 (£263) each. That represents a painful but less dramatic fall of around 13 per cent over the last seven days.

The digital currency caught everyone's attention last December, when the price of an individual bitcoin shot up to around $1,150. Since then, thousands of businesses including shops and payment-processing firms have started to accept bitcoins as a payment for their goods and services. The larger acceptance for the digital currency should theoretically stabilise the currency's value, but some are speculating that the fall was partly due to the greater number of businesses accepting bitcoins, leading to more of the coins being in circulation - more being 'cashed in'.

Garrick Hileman from the London School of Economics has a different explanation Hileman thinks that the recent swings in value were related to speculative trading, with the steady supply of new bitcoins introduced each day being one significant factor. "Approximately every 10 minutes 25 new bitcoins are mined into existence, which works out to approximately 3,600 new bitcoins created every day. At current prices that's $1.2m in new supply coming into existence every day." He went on to explain "How much of this $1.2m miners have to sell to pay for these things [bitcoin mining] is a closely guarded trade secret, but unless the market can absorb the new bitcoins which miners sell, the price will fall."

However, posters on Reddit's r/Bitcoin, a popular forum for bitcoin enthusiasts, remain mostly positive in the face of the scare. One user commented: "Who else is enjoying the firesale? Who else is picking up tons of cheap bitcoin?"

Roger Ver, an investor into several Bitcoin start-ups also points out in a Tweet: "For anyone complaining about the current price of Bitcoin, remember it has more than doubled over the last 12 months." The Tweet showed a graph of values from Bitstamp, which indicates a $120 Bitcoin value at this time last year.