The cost of business

Tech researcher Strategy Analytics has released a report entitled ‘Western Europe's mobile market still searching for growth', in which it reveals that mobile operators are experiencing a slow decline in their earnings (EBITDA), due to the increased overheads associated with competing in the smartphone market.

As arguably the most mature mobile phone market in the world, Western Europe is not recovering from the global recession in the same way the rest of the world is. SA puts this down to the smartphone revolution, and the associated increased costs of subsidizing handsets and hosting the explosion in data traffic.

While some of the blame for can be placed at the feet of the many European countries experiencing a debt crisis, it's thought that the underlying problem is an increase in OPEX caused by insufficient adaptation to the new mobile data realities. In other words, they could do more to lower the costs of providing mobile data.

"This weak performance is less about the after-shocks of the global recession and more about the changing data-centric market environment. Subsidies associated with smartphone sales and upgrades, and the relentless growth in data traffic from these devices, reversed the long-term trend of falling OPEX per subscriber," said the author of the report, Phil Kendall.

"For example, the average cost to retain a customer has increased for T-Mobile in several countries: Germany (26%), Austria (57%) and the Netherlands (12%). Orange customer retention costs have increased in France (11%) and Spain (14%)."

We spoke to Kendall to get further clarification on his report. Historically Western European mobile operators have had a 40 percent margin from their EBITDA, but that's down to 39 percent now. While that's still a healthy margin, the trend is heading in the wrong direction for them. One of the things operators will be hoping for is that smartphones in general become cheaper, thus reducing the cost of subsidizing them.

We also asked about the competitive pressure from Three in the UK via its ‘all you can eat' mobile broadband packages. Kendall revealed this has resulted in healthy subscriber growth for Three over the past 6-9 months, but not necessarily a big increase in the bottom line. This is a further indication of how competitive the market is.

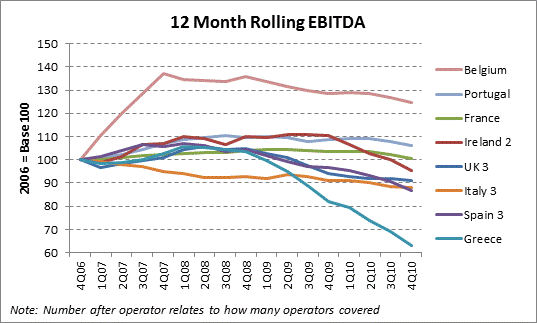

Here's Kendall's chart illustrating the trend in EBITDA in selected Western European countries over the past few years. As you can see, in many cases the downward trend increased last year, especially in those countries experiencing the biggest macroeconomic challenges.