More comment

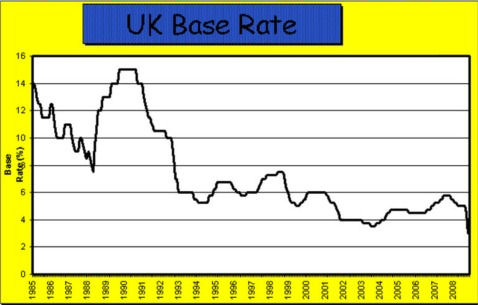

Since the beginning of the year, the Committee has set Bank Rate to balance two risks to the inflation outlook. The downside risk was that a sharp slowdown in the economy, associated with weak real income growth and the tightening in the supply of credit, pulled inflation materially below the target. The upside risk was that above-target inflation persisted for a sustained period because of elevated inflation expectations. In recent weeks, the risks to inflation have shifted decisively to the downside.

As a consequence, the Committee has revised down its projected outlook for inflation which, at prevailing market interest rates, contains a substantial risk of undershooting the inflation target. At its November meeting, the Committee therefore judged that a significant reduction in Bank Rate was necessary now in order to meet the 2% target for CPI inflation in the medium term, and accordingly lowered Bank Rate by 1.5 percentage points to 3.0%.

Here's a graph of UK interest rates since 1985 courtesy of houseweb.co.uk: