Cash and carry

2009 was a year of achievements for AMD, said Seifert, if taken in the context of a very weak macro environment. The firm, he said, even managed to exceed expectations in a couple of areas, being first to market with the thin and light platform and staying ahead of the game when it comes to graphics.

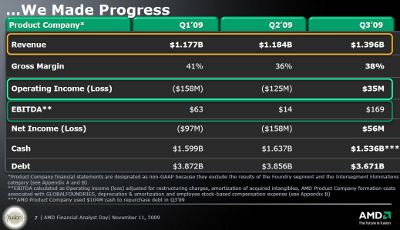

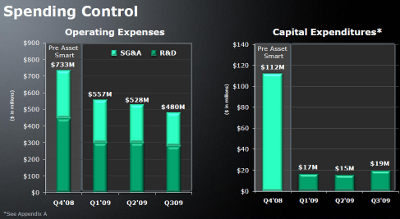

"We coupled execution on the product side with financial control," he said, noting the firm had brought down operating expenses "significantly." Yet, despite the cost reductions and cutbacks, he said the firm had managed to keep its roadmap intact, had worked "very hard to increase operational efficiencies," and had "brought revenue into the bucket." Gross margin, he said, was also now the right size.

Seifert told HEXUS of the importance attached to AMD's having around $1.5 billion in cash, despite a balance sheet debt of 3.6 billion, which he plans to tackle over three years. He described AMD's cash liquidity level as "comfortable" and said he felt that having a billion dollars or even slightly less would be adequate moving forward. "We keep liquidity at the forefront of our minds," he added.

"We want to stay ahead of the curve, keep our nose above the water," said Seifert emphasising that expense control discipline would remain throughout 2010, with the goal of keeping AMD in "consistent profitability."