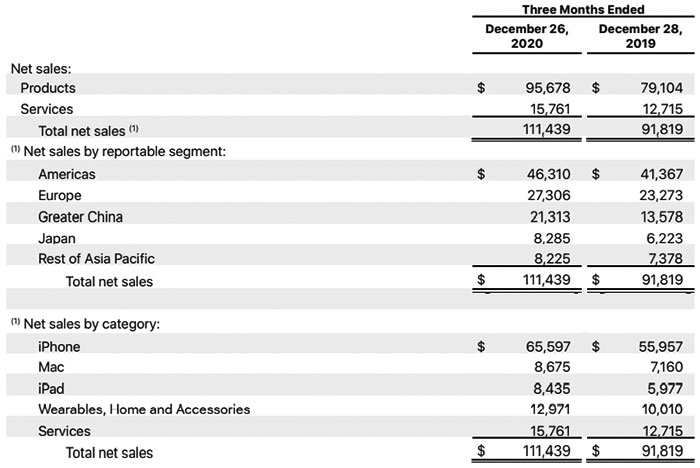

Apple has just announced its latest set of quarterly results which cover the three months leading up to 26th December 2020. It refers to this period as its fiscal first quarter (Q1) of 2021. The results were great for Apple, it posted record quarterly revenue, at $111.4 billion, which is up 21 percent year over year (YoY). For another perspective, Q1 2021 marks the first quarter for Apple where it has racked up more than $100 billion in sales.

With that most recent quarter encompassing the launch and release of the new iPhone 12 smartphones one might not be surprised that Apple raked in lots of cash. It launched four variants of the iPhone 12; the iPhone 12 and iPhone 12 Mini, as well as the iPhone 12 Pro and iPhone 12 Pro Max. All the phones came packing the new Apple Bionic A14 SoC and 5G connectivity but were differentiated by screen size, and the Pro models came packing more sophisticated camera systems and greater max storage options.

The new iPhones lifted revenue from this business segment by 17 per cent YoY to an all-time record of $65.6 billion in a single quarter. Apple doesn't provide unit sales figures for its products but research firm IDC estimates that it sold 90.1 million iPhones during the quarter.

Apple's bumper quarter has added fuel to those following the so-called 'super cycle' investor thesis. This particular iPhone generation is thought to be part of such a cycle as it delivers a new design with 5G across the range – inspiring lots of hold-out upgraders and switchers. Nevertheless, in a post results interview Apple CEO Tim Cook indicated that results could have been better without the pandemic closing down physical stores.

Though it easily steals the limelight, the iPhone wasn't Apple's only good earner during the quarter. "Our December quarter business performance was fuelled by double-digit growth in each product category, which drove all-time revenue records in each of our geographic segments and an all-time high for our installed base of active devices," said Luca Maestri, Apple's CFO.