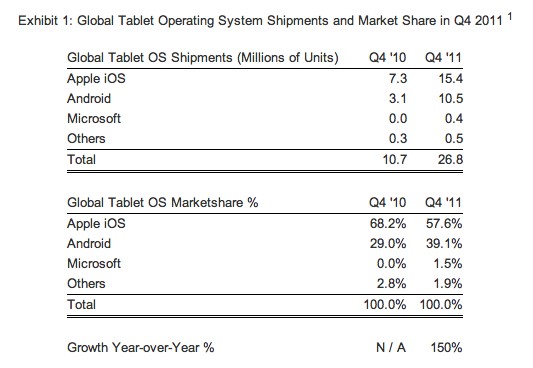

Numbers from the ongoings of 2011 are beginning to roll-in and market researcher, Strategy Analytics, has been crunching away to bring us the details of tablet shipments and market shares from last year.

It's clear that Apple still holds the majority share with 57.6 per cent of the market, however, this is a 10.8 per cent drop in market share over 2010; with Microsoft tablet sales remaining relatively static all the points go towards Google's Android, that has opposingly increased its market share by 10.1 per cent. Mind you, this comes as little surprise, prior to 2011, Android tablets lacked the tablet-friendly Android 3.x honeycomb operating system and as such lacked large brand name backers; since 2011, we've seen the release of premium high-end Android tablets from the likes of ASUS, Motorola, Samsung, Sony, LG and Acer with other well known firms such as Amazon and its Kindle Fire, joining in with affordable, yet relatively performance-packed tablets, able to reach market price-points yet to be touched by Apple.

The bottom line, however, is that despite losses and gains in market shares, few firms, perhaps with HP and RIM as the exceptions, have lost in the still expanding tablet market last year, as it saw an increase in growth of 150 per cent and so whilst firms may be fighting for a larger slice of the pie, it's not yet time to worry, as the pie itself continues to grow at an incredible rate.